9 most exploded crypto coins, platforms, and projects in the last year

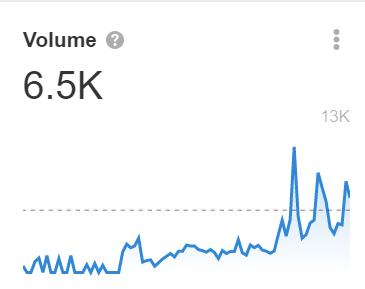

MakerDAO

Makerdao is a decentralized finance (DeFi) protocol that utilizes the Ethereum blockchain to provide loans and stablecoins. The protocol’s native token, MKR, is used to collateralize these loans and stabilize the value of the stablecoins. Makerdao was one of the first DeFi protocols to launch on Ethereum and has become one of the most popular protocols in the space. Makerdao’s popularity is due to its lending rates, which are often lower than traditional financial institutions, as well as its use of collateralized debt positions (CDPs), which helps to reduce risk.

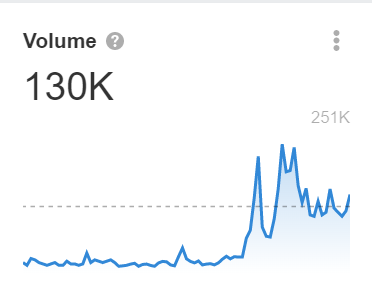

AAVE

AAVE is a crypto-based lending and borrowing platform that has become popular in recent years. One of the reasons for its popularity is that it is seen as a safe place to invest and borrow. There are a number of things that make AAVE safe, including its use of collateral, its focus on transparency, and its commitment to security. All of these factors make AAVE an attractive option for those looking for a safe place to invest or borrow.

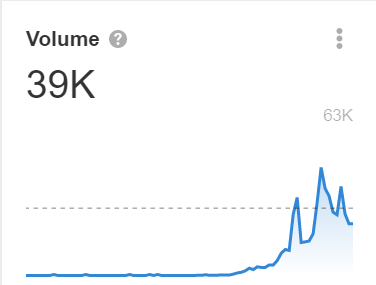

Crypto.com

Crypto.com is a cryptocurrency exchange that allows users to buy, sell or hold cryptocurrencies.

One of the main reasons that the platform has become so popular is the ability to support a variety of different cryptocurrencies. The platform is also easy to navigate, users can trade cryptocurrencies with just a few clicks. Crypto.com also offers a variety of different features, such as a mobile app that makes it easy to trade on the go.

Another reason is that Crypto.com is a very safe and secure platform. The exchange uses state-of-the-art security measures to protect user data and funds. Crypto.com also offers insurance for all user funds, which means that users can be sure that their money is safe even if something happens to the exchange.

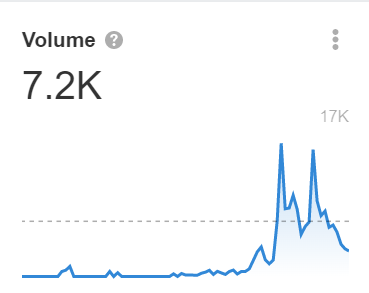

MoonPay

MoonPay is a popular cryptocurrency payment processor that allows users to buy, sell, and spend digital currencies. The platform is simple to use and offers a variety of features that make it an attractive option for those looking to get into the cryptocurrency world. MoonPay also offers a mobile app that makes it easy to keep track of your account balance and transactions on the go.

One of the main reasons why MoonPay is safe is because it uses what is called a “cold storage” system to store all of its user’s digital currencies. This means that your coins are stored offline in a secure location and are not connected to the internet. This makes it much more difficult for hackers to access your account and steal your funds. Additionally, MoonPay requires two-factor authentication for all account login attempts. This adds an extra layer of security by requiring you to enter a code from your mobile device in addition to your password.

Overall, MoonPay is a great option for those looking for a simple and convenient way to buy, sell, and spend cryptocurrencies.

Decentralized finance

Decentralized finance (DeFi) is a financial system that runs on the Ethereum blockchain. DeFi apps are built on top of Ethereum and use smart contracts to provide financial services without the need for a centralized third party, such as a bank or a financial institution.

The DeFi ecosystem is growing rapidly and currently includes a wide range of applications, such as lending and borrowing platforms, stablecoins, decentralized exchanges, and more.

The advantages of DeFi are:

- it is open to everyone

- it is permissionless (no one needs to approve you to use it)

- it is censorship-resistant (no one can prevent you from using it).

Decentralized finance tokens are skyrocketing today because they offer a lot of advantages over traditional financial assets. For one, they’re much more accessible to a wider range of people. Secondly, they’re much less expensive to trade and hold. Finally, they offer a high degree of transparency and security. All of these factors make them an attractive investment for many people.

Coingecko

Coingecko is a cryptocurrency data and research platform. The company was founded in 2014 by TM Lee and Bobby Ong, and is headquartered in Singapore. The platform provides data on over 5,000 cryptocurrencies, including price information, CoinMarketCap rankings, 24-hour trading volume, and more. In addition to crypto data, Coingecko also offers users market insights, analysis, and educational resources.

FTX

FTX is a popular cryptocurrency exchange that offers many features and benefits to its users. One of the most appealing aspects of FTX is the vast array of cryptocurrencies that are available to trade on the platform. There are over 100 different types of digital assets listed on FTX, which provides traders with a wide range of options when it comes to choosing what to trade. In addition, FTX also offers leverage trading, meaning that traders can take advantage of price movements by using borrowed funds. This can amplify profits (or losses) but also makes trading riskier. Nonetheless, the high level of liquidity on FTX and the low fees charged make it a popular choice for many cryptocurrency traders.

Defi Lending

Decentralized lending is a type of lending that happens on the blockchain. With decentralized lending, there is no centralized authority that controls the loan process. Instead, lenders and borrowers interact directly with each other using smart contracts. This type of lending can be done with any asset that is stored on the blockchain, such as cryptocurrency.

There are many advantages to decentralized lending:

- One advantage is that it can help to reduce counterparty risk. When you take out a loan from a centralized institution, you are relying on that institution to hold up its end of the bargain. If the institution goes bankrupt or otherwise fails to meet its obligations, you may not get your money back.

- With decentralized lending, there is no central institution involved. Instead, smart contracts are used to enforce the terms of the loan. This means that if one party fails to meet its obligations, the other party can still get their money back.

- Another advantage of decentralized lending is that it can help to reduce fraud. When you take out a loan from a centralized institution, there is always the risk that the institution will not send you the money you are owed. With decentralized lending, smart contracts are used to track the loaned funds. This means that if the borrower does not receive the funds, the lender can still get their money back.

- Finally, decentralized lending can help to reduce the cost of lending. When you take out a loan from a centralized institution, you have to pay fees to the institution. With decentralized lending, there are no fees involved. Instead, lenders and borrowers can agree on a rate that is fair to both parties.

Crypto insurance

Crypto insurance is insurance against the loss of cryptocurrency assets, typically provided by special insurers. It can cover losses arising from theft, hacking, scams, and other risks.

There is a growing demand for crypto insurance as the value of cryptocurrencies has risen sharply in recent years. Many companies and individuals hold significant amounts of crypto assets, which puts them at risk of substantial losses if they are stolen or lost.

Insurers have responded to this demand by offering a range of policies that provide protection against different types of risks. These policies can be customized to meet the needs of individual policyholders.

Crypto insurance can provide peace of mind to those who hold cryptocurrencies, and help to protect against financial losses arising from theft.

Author Sviat Pinchuk

Crypto Journalist (COO) at Tradecrypto.com

Man who simply bought some BTC for domestic needs in 2014 and then forgot about it till 2017.

The dude who got Etherium in 2017 by misclick and sold it in 2018 “just to try”.

Lost 1 Florida house in XEM in 2018, Sviatoslav finally decided to trade reasonably and now he is one of the most analytical and data-driven trader in Crypto Industry.